Gaming and E-sports are a big market, getting bigger, and attracting consumers difficult to reach any other way.

Businesses have advertised to consumers for centuries, based on the premise that they could extol the virtues of their products to any audience whose attention they could attract. In the U.S., that arguably began in 1704, when an announcement seeking a buyer for an estate in Oyster Bay, Long Island, was published in the Boston News-Letter.

But the key element is getting the audience’s attention. There’s no point in any company conveying its products’ benefits if nobody is reading, listening, or watching.

And increasingly, the traditional media for reaching consumers – television, print publications, radio – are going away. According to research from TruOptik, as of last month, more homes have a Connected TV than a cable box; more Americans stream radio than listen over the airwaves; and more money is made through in-game purchases and advertising than from the sales of the games themselves.

Anyone who wants to reach an audience – especially a younger one – has to consider alternatives. One of the most intriguing alternatives is gaming and e-sports. If you think those are minor players, the numbers collected here will disabuse you of that notion.

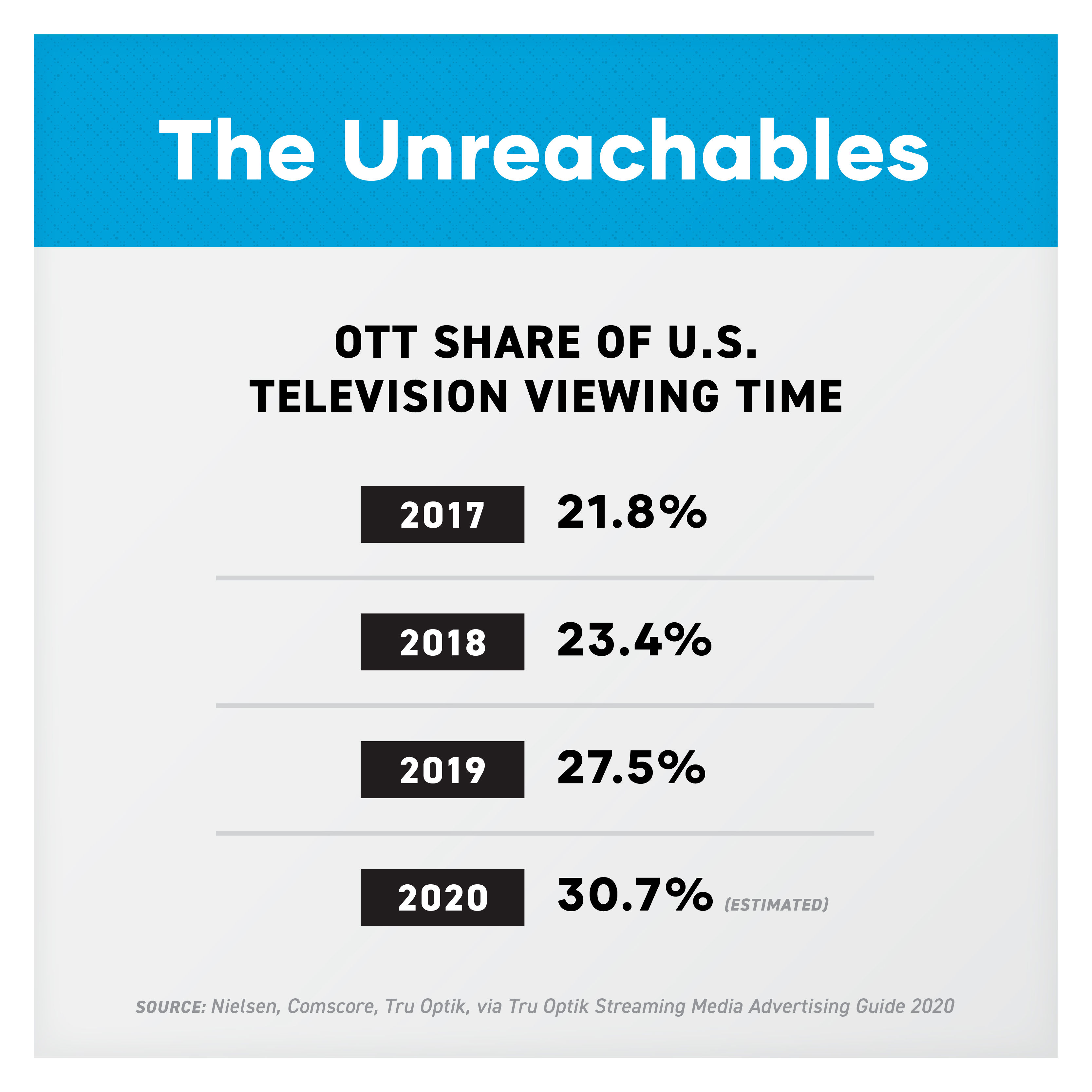

The Unreachables

Consumers are busy “cutting the cord” by deleting traditional TV from their lives. Instead of “linear TV,” they often choose “over the top” (OTT) film and television content, using high-speed Internet connections rather than a cable or satellite provider. Note that OTT does not mean free content such as YouTube; the term encompasses services such as Netflix, Amazon, iTunes, and HBO Now.

More to the point: OTT lets consumers watch their shows without interruption. While some services do rely on advertising, such as Peacock and Hulu, and others have no intention of adopting an advertising model.

According to a study performed by Hearts & Science, a unit of Omnicom, nearly half of U.S. adults 18-49 qualify as “Unreachables,” because they are inaccessible to traditional TV advertisers. OTT accounts for two thirds of Unreachables’ TV consumption: They watch only 10 hours of linear TV a week, 75% less than the average household.

This goes beyond traditional media channels. There are growing barriers within new media such as social media due to privacy regulations, content guidelines, and the manner in which providers respond to them. For example, Google plans to restrict advertising software companies and other organizations from connecting their browser cookies to websites they do not operate. That ends a lucrative tracking tool for advertisers.

So you should look for new opportunities. Enter gaming and e-sports.

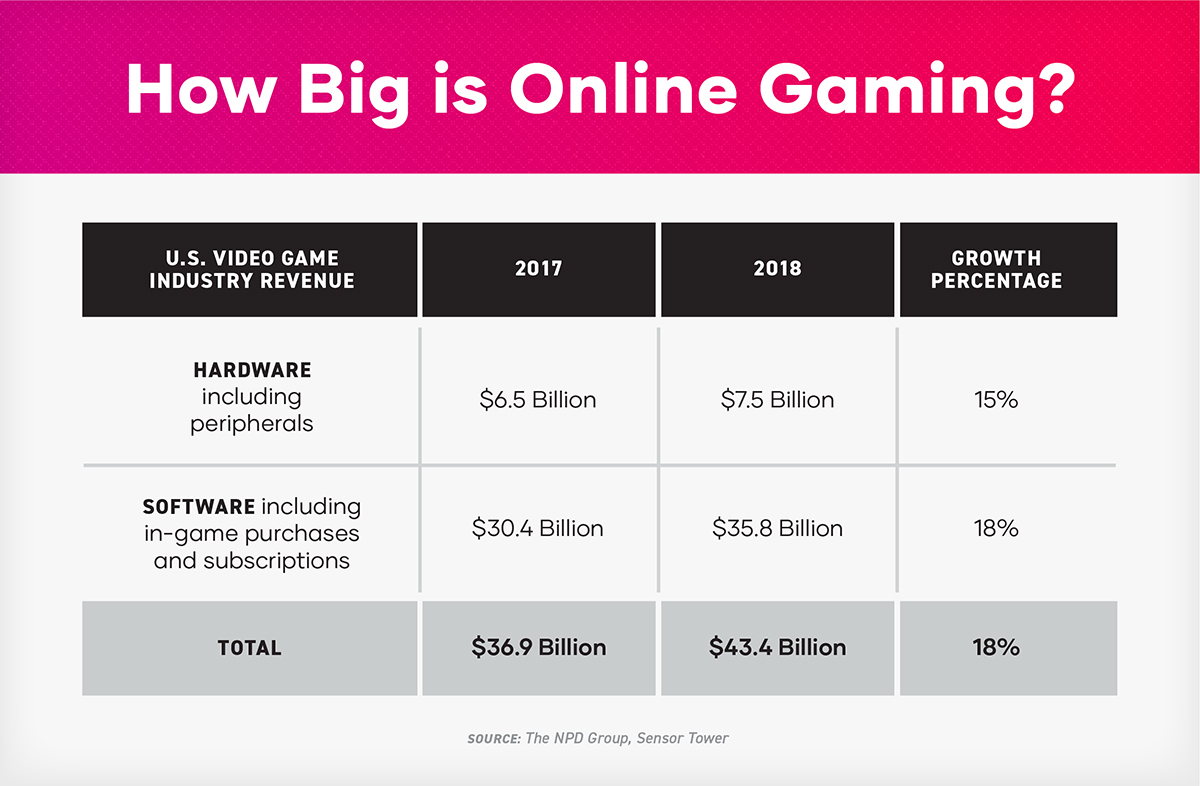

<3>How big is online gaming?

Those numbers are conservative. Mobile players spent about $61.7 billion on games in 2019, according to market analyst Sensor Tower, up 12.8% from 2018 and its $54.7 billion total. According to the researchers, games make up 68% of total iOS App Store revenue and 84% for the Play Store.

According to research firm NPD Group, “Over 164 million adults in the United States play video games, and three-quarters of all Americans have at least one gamer in their household. And despite assumptions that games appeal primarily to young people, 65% of American adults play video games. The average gamer is 33 years old and has been playing for 14 years.”

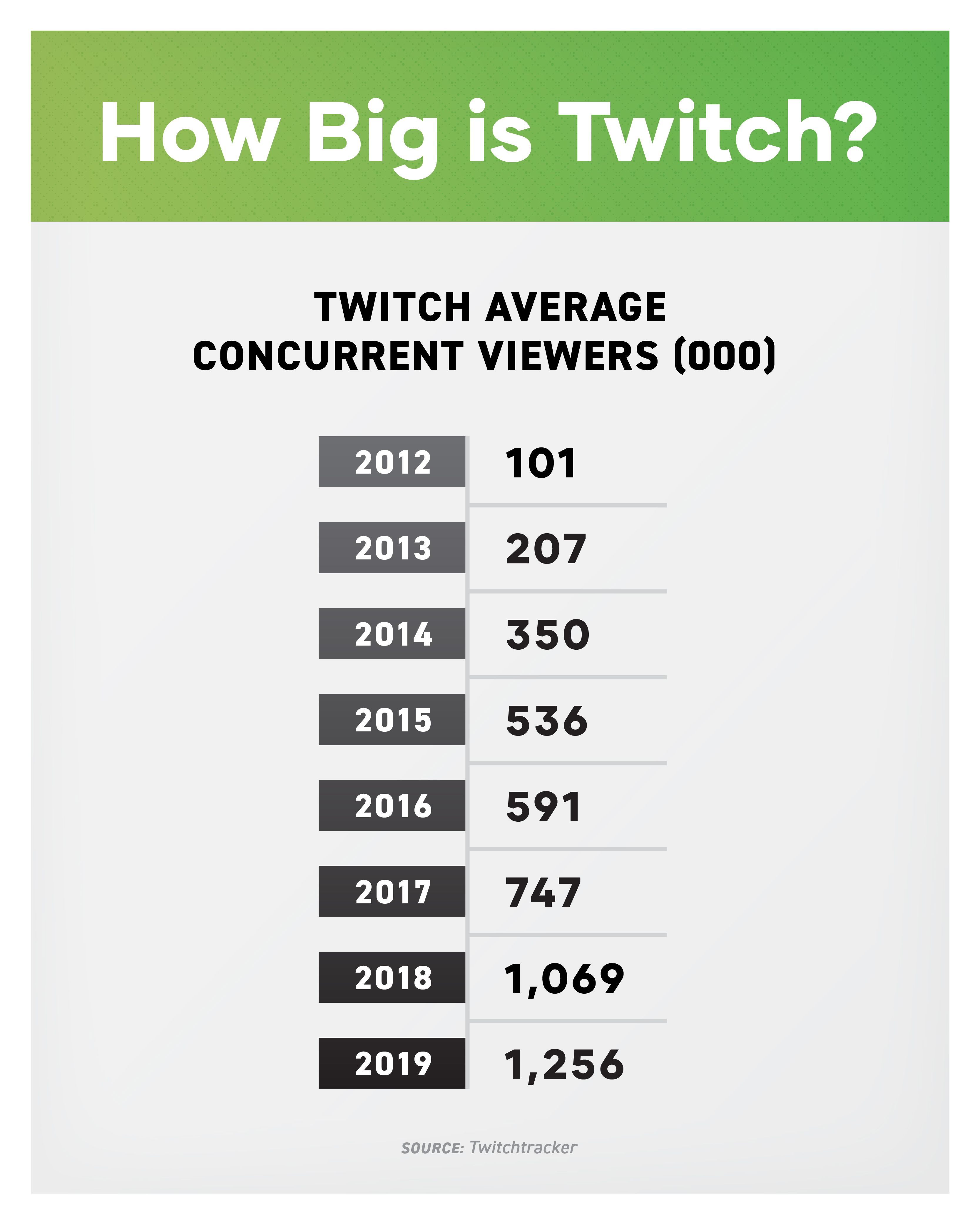

How big is Twitch?

Twitch is a livestreaming platform focused on video games. By 2013, it had attracted 45 million unique visitors, which got Amazon’s attention. It became an Amazon property in 2014, with just short of $1 billion changing hands; today’s it’s included in Amazon Prime. It’s undeniably popular, and according to Business of Apps, Twitch accounts for 1.8% of peak internet traffic – behind only Netflix, Apple, and Google.

By 2018, Twitch had 2.2 million broadcasters and 15 million daily viewers, of whom around a million could be found using the platform at any given time. The platform allows streamers to make money by offering in-stream links through which viewers can purchase the games being played.

One unique difference: Unlike gaming in general, which is roughly equal across gender, Twitch is an overwhelmingly male-dominated platform. Men make up 81.5% of its userbase.

Some game developers use in-game advertising as a monetization strategy to boost their game’s revenue. The game may be a free download, which encourages downloads; then the game developer earns money and gets paid by showing mobile game ads to their users.

U.S. In-Game Advertising Revenue

As of 2017, 71% of Android games and 80% of iOS games were monetized by advertising, reported WePC’s statistics. In-app ad impressions are a mix of banner advertising (79%), rich interstitial ads (14%), rewarded video (4%), and video interstitial (2%) (per those 2017 numbers).

It’s clear that people are clicking on those ads. In 2015, gaming apps’ mobile app store revenues amounted to US$24.8 billion. And, reported Business of Apps, “Since 2016, we’ve seen 75% growth in global app revenue, according to this app revenue data.”

There are other options beyond the game-equivalent of a banner ad, though not all are successful. One notable (and entertainly odd) failure was the 1999 game called Pepsiman which was developed specifically for the purpose of promoting the brand and product. It fizzled.

In-game ads are not experienced as “advertising,” asserts the TruOptik report. “Even subscription services like Stadia and Apple Arcade are expected to explore in-game advertising opportunities, much like premium television channels such as HBO generate revenue from product placements. The difference is in-game ads can be targeted in real time based on the needs and interests of individual players,” it concludes. (Note: The company sells OTT services, which gives them an understandable bias.)

How big is e-sports?

Organized gaming competitions among professional players and teams – e-sports – absolutely is taking off. Today, e-sports revenues exceed $1 billion worldwide, with audiences of more than 443 million across the globe, according to research by Green Man Gaming. Since 2012, the audience has more than tripled, the company reports. One notable example of its popularity: Fortnite is now a high school and college sport.

Not long ago, market research firm NewZoo estimated e-sports online competitive multiplayer matches to reach 453.8 million by the end of 2019. “On its current trajectory, we estimate the e-sports market will generate $1.8 billion in 2022,” the researchers conclude. It’s quite an example of a hockey stick graph: In 2015, the global audience for e-sports was $115 million.

Over a third of gamers have watched a live gaming stream in the past month, with more than a quarter having watched an e-sports tournament, according to the Gaming: The trends to know in 2019 report. That’s particularly so outside the U.S. “More than four in 10 people in the Philippines have watched a live gaming stream in the last month, compared to 8 percent in Switzerland,” it says.

Multiple revenue streams are connected to e-sports, including advertising, sponsorships, media rights, ticket sales to live events, and merchandising. And, as one 2019 wrap-up suggests, advertisers are ready to play. “E-sports ad revenues in the US are poised to surpass $200 million by [2020], according to our first forecast on e-sports and gaming revenues. … Digital ad revenues from e-sports in the US will grow 25% to $178.1 million this year.”

This is all part of a larger transition, of course. As consumers move away from traditional media, the advertisers need to explore new ways to segment the audience and direct their messaging.

For example, “The ways brands reach target consumers and the ways media companies monetize content have dramatically changed,” reports TruOptik. Although $20 billion will be spent on streaming media advertising in the U.S. this year, it’s more finely tuned. “Four out of every five targeted OTT impressions uses advanced characteristics and use of advanced targeting data increases as advertisers gain confidence with OTT. When OTT advertisers do choose to target on demographics, they’re much more likely to segment audiences according to income as opposed to the traditional linear TV dimensions of age and gender.”

There’s a lot of opportunity in these markets. Are you ready to play?