By John Dick, Founder and CEO of CivicScience

Back in February, our team at CivicScience anointed 2023 as “The Year of Emotional Well-Being.” Everything about our data suggested that consumers were shuffling their spending priorities and lifestyles in unprecedented ways. Still reeling from Post-Pandemic Stress Disorder (PPSD), they were focusing on what made them feel good, often in the face of financial headwinds, bucking decades – if not the entirety – of conventional economic wisdom.

That proclamation has continued to prove itself out.

The explosive sales in prestige beauty, the rise of nostalgia in consumerism, the record number of Americans taking vacations this past summer, and the continued urge to splurge – in the face of persistent inflation and economic strains – all reflect Americans’ conscious or unconscious desire to feel better, at any cost. This trend is particularly pronounced among women and Gen Z, who have consistently reported higher levels of emotional strain than the general population since the early days of COVID.

Well-being, almost singularly, explains the unprecedented patterns of trading off and trading down we’ve seen from consumers. It’s not just about moving from “goods” to “experiences.” It’s about the conflation of the two. Even people with high inflation concerns continue to spend more on premium food ingredients, while spending less on things like iodized salt or storage bags. Cooking quality meals makes people feel good. Ziplocs don’t.

Did you know the largest average check sizes in the quick service restaurant (QSR) category today are coming from lower-income consumers? That’s because, as people trade down from more expensive restaurants, they’re still prioritizing the “occasion” of dining out, the feeling.

It goes beyond anecdotal.

Our company has invested heavily this year in the development of new forecasting and predictive modeling capabilities, buoyed by a massive increase in our data collection, which now sees us gathering upwards of 5 million survey responses every day. And thanks to the magic of AI, we can crawl billions of time-stamped answers to tens of thousands of survey questions in our database to stitch together indices that both forecast all manner of things and identify key outcome drivers.

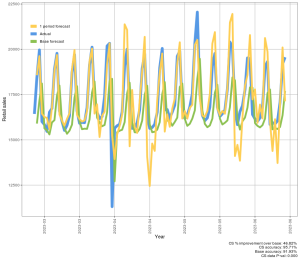

This is what our national retail sales forecasting model looks like:

Our models are showing a 95.7% accuracy on a monthly basis, 94.8% at 3-months, and 94.4% accuracy at 6-months. Not bad for our early efforts.

But here’s the more interesting part: These are the questions and answers in our database the AI discovered that – in combination – most accurately predict retail sales:

The first four are intuitive. It’s the economy, stupid. If I feel confident about my personal finances and the economy, I spend more. If not, I spend less.

The first four are intuitive. It’s the economy, stupid. If I feel confident about my personal finances and the economy, I spend more. If not, I spend less.

Equally impactful to the model, however, are four emotional attributes: varying degrees of sadness, stress, and fear. They ranked above hundreds of questions we track about shopping behavior, inflation, or anything else.

In other words, well-being drives – and predicts – consumer behavior as much as anything else today. Believe the algorithms if you won’t take my word for it.

It’s possible this could change as household financial belts tighten. The return of student loan payments or a worsening job market could be the straw that breaks the Well-Being Camel’s back. But we don’t think so. If anything, consumers will dig in their heels to protect the spending categories they value most, while looking to cut back in areas they don’t.

Retail marketers would be wise to lean into this phenomenon. Highlighting and communicating “the experience of physical goods” is essential to winning today’s consumer, again, especially women and Gen Z.

PPSD is real. And it could be a generation until it’s gone.